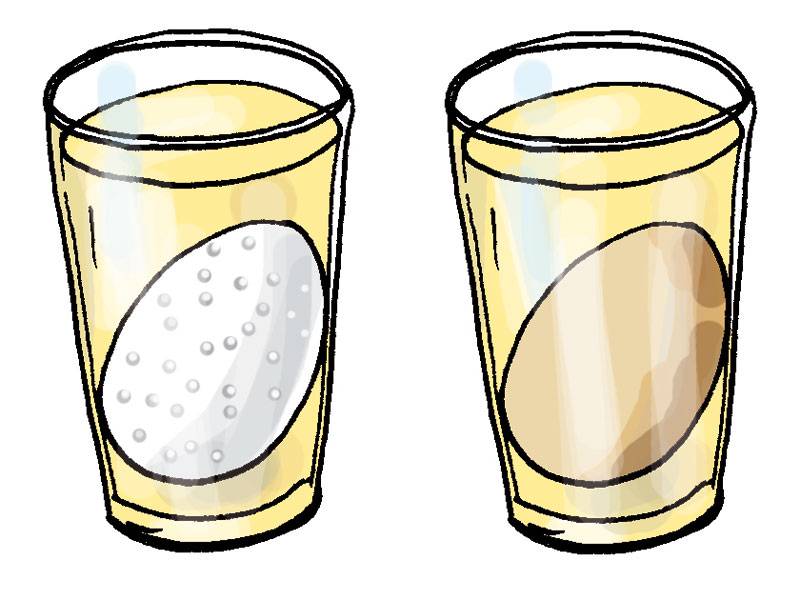

30 DAYS EXPERIMENT EGGS VS Coca Cola YouTube

Employment Insurance (EI) Clients.. laws and the WorkBC Employment Services Contractor has confirmed that you are legally eligible to work in British Columbia. Active EI Claimants Receiving Special Employment Insurance Benefits. If you are receiving temporary EI special benefits for a specific purpose (maternity, parental, sickness), you may.

Ei experiement mit coca cola YouTube

This calculator estimates the amounts of regular benefits that could be received under the Canada Employment Insurance (EI) program. Provide the input values as required, then click Calculate to display the result. Province / Territory: Economic region: Hours of insurable employment: Average weekly income: - or - Annual income:

Что если сварить яйцо в КокаКоле *** Boil egg in CocaCola (experiment) YouTube

Employment Insurance (EI) Program Characteristics - Canada.ca Canada.ca EI Economic Regions EI Program Characteristics for the period of December 3, 2023 to January 6, 2024 Violations from previous EI claims may increase the number of hours required to qualify for EI benefits. For more information on eligibility requirements . Footnotes

Egg in Coca Cola for 1 month Experiment wideo w cda.pl

Item 1 of 2 Pause Regular Employment Insurance beneficiaries (year-over-year change) — Canada October 2023 1.5% (12-month change) Source (s): Table 14-10-0011-01 . The number of Canadians receiving regular Employment Insurance ( EI) benefits was little changed in October (+0.7%; +2,900) and stood at 443,000.

Rezept Chinesisches Sol Ei mit Cola (Soja Cola Ei) YouTube

(Darryl Dyck/The Canadian Press) New tax measures, and changes to existing ones, will begin affecting Canadians in 2024. But tax experts say the effects on most individuals are likely to be minor,.

Günther Eisen CocaCola Ei OstereiMuseum Erpfingen museumdigitaldeutschland

Employment Insurance (EI) provides regular benefits to individuals who lose their jobs through no fault of their own (for example, due to shortage of work, or seasonal or mass lay-offs) and are available for and able to work, but can't find a job. Always apply for EI benefits as soon as you stop working.

Das WabbelEi Pindactica

With this Employment Insurance (Ei) Calculator, you can calculate the associated contributions due for Employment Insurance (Ei) in British Columbia based on your annual income in the 2024 tax year, this includes, where appropriate, employee and employer employment insurance (ei) contribitions. British Columbia Income Tax Calculator for 2024.

Experiment mit Ei und Cola YouTube

Apply online Provide supporting information A benefit statement and access code will arrive by mail Check the status of your application Prepare to apply Complete and submit your online application right away. If you apply more than 4 weeks after your last day of work, you may lose benefits. When you apply, you'll need:

Ei mit Cola wird durchsichtig 😳 YouTube

The Access Code is the four-digit code that was sent to you by mail shortly after you applied for Employment Insurance benefits. Your Access Code is your electronic signature and is required, along with your Social Insurance Number (SIN), when you submit your reports or make enquiries about your claim.

Proef ei in cola Egg As Food

The Canadian Press Staff Contact Published Jan. 1, 2024 4:27 a.m. PST Share TORONTO - Middle-income earners will start seeing a larger portion of their paycheques going toward Canada Pension Plan.

Experiment für Kinder Sonstige Experimente HärteTest für Zähne

Canada's Employment Insurance Economic Regions. This map also includes a long text description below. A map of Canada showing the Employment Insurance regional boundaries. Newfoundland and Labrador. Prince Edward Island. Nova Scotia. New Brunswick. Quebec. Ontario.

Ei in Cola Experiment YouTube

On November 1, 2024, the Government of Canada announced changes to contributions for both Canada Pension Plan (CPP) and Employment Insurance (EI) for the 2024 calendar year.

Ice Cube Droped in Cola Glass and Cola Splashing Stock Image Image of background, soda 58876651

Applying for Employment Insurance (EI) Benefits EI and Pensions You can receive EI benefits and your pension at the same time. If you return to work, work enough insurable hours, and meet the requirements for setting up an EI claim, your pension income will not be deducted from your EI benefits. Working Volunteering Related Information

PEPSICola with lemon330mLPEPSI TWIST MIT EIGermany

The number of Canadians receiving regular Employment Insurance benefits rose by 9,800 (+2.5%) to 399,000 in May, the first increase since July 2022.This was driven by increases in Quebec (+10.2%) and British Columbia (+6.1%). Meanwhile, the number of regular EI beneficiaries fell in the four Atlantic provinces.. According to the Labour Force Survey (), the unemployment rate in Canada rose 0.2.

Experiment met ei in fles NEMOchallenge YouTube

For most people, the basic rate for calculating Employment Insurance (EI) benefits is 55% of their average insurable weekly earnings, up to a maximum amount. As of January 1, 2024, the maximum yearly insurable earnings amount is $63,200. This means that you can receive a maximum amount of $668 per week.

CocaCola Kuchen Kochen mit Diana

Key Takeaways. Employers in Canada are responsible for deducting and matching employees' CPP/QPP and EI contributions. Employers' payroll obligations include withholding the correct amount of income tax from their employees' pay. How often employers need to remit these payroll contributions and source deductions depends on their remitter.